Insurance fraud is rising fast. In 2024, Allianz UK (a major insurer) uncovered £157.24 million in fraudulent claims—a 10% jump from the year before. That’s roughly 90 cases a day, totaling £430,000 in attempted fraud daily. And these trends highlight the growing need for tamper technologies in claims and loss recovery.

Tamper-evident solutions help prevent evidence tampering! They provide insurers with clear, physical proof, reducing disputes, speeding up resolution, and protecting both parties. In this article, we’ll explore how these solutions work and how they support stronger, faster, and more credible insurance claims!

Why Insurance Claims Are Often Rejected or Delayed?

One of the most common reasons for claim rejection is incomplete or inconsistent documentation. If key records—like shipment photos, seal logs, or chain-of-custody forms—are missing or unclear, insurance companies may flag the claim for further review or reject it entirely. The same applies when there’s no visual or physical evidence showing that tampering occurred.

Without proof, insurers find it difficult to verify when or where the damage happened, especially in complex supply chains with multiple handovers.

Another major issue is timing. Many claims fall into dispute because it’s unclear whether the damage took place before or after delivery. Carriers may deny responsibility, and without tamper-evident packaging or tracking systems, it’s hard to prove fault.

At the same time, growing insurance fraud has made claims handlers more cautious. Insurers now apply tighter checks, ask for stronger proof, and scrutinize claims more closely than ever, especially as false claims rise in the wake of economic pressure.

What Insurers and Law Firm Teams Need to Validate a Claim?

To validate an insurance claim, insurers and legal teams need clear, well-documented evidence that distinguishes between actual product damage and packaging tampering.

Tamper-evident solutions, combined with photos, videos, and chain-of-custody records, create a strong hierarchy of proof that accelerates claim approvals and minimizes disputes.

In the following table, key requirements and their impact on claim validation are summarized:

| Validation Element | Why It Matters |

|---|---|

| Tamper-Evident Packaging | Establishes breach timing and supports admissibility in court |

| Photo/Video Evidence | Strengthens narrative with visual proof |

| Chain-of-Custody Documentation | Builds transparency and accountability across the supply chain |

| Compliance with ISO 17712 / TAPA / C-TPAT | Speeds up insurer verification and meets legal requirements |

| Serialized Security Seals or Labels | Makes it easier to track tampering events and validate claims |

| Incident Reports or Witness Statements | Supports claims with firsthand accounts |

When combined, these elements offer a clear line of sight across the entire shipping and handling process. They reduce uncertainty, speed up investigations, and improve the odds of a claim being accepted, whether an insurance company, underwriter, or legal team reviews it.

What Are Tamper-Evident Solutions for Loss Recovery?

Tamper-evident solutions play a critical role in recovering losses and strengthening insurance claims. They provide physical evidence that a package, product, or document was accessed without authorization. When damage or theft occurs, these tools help prove that the item was left in your facility in good condition. This removes doubt from the claims process.

Each solution offers a different layer of protection depending on the type of goods, level of risk, and chain of custody involved. Here are different types of tamper-evident solutions commonly used in loss recovery:

- Void Labels: Leave a clear “VOID” or pattern when peeled or tampered with, making unauthorized access instantly visible.

- Tamper-Evident Tapes: Show signs of cutting, lifting, or heat exposure, and often leave a hidden message behind.

- Security Seals: Used on containers or crates to track access points; breakage signals potential tampering.

- Serialized Labels: Adds traceability by linking each package to a unique ID, which helps verify its original state.

- Tamper-Proof Bags: Designed for secure handling of legal documents, financial records, and high-value items during transit.

By using these solutions consistently, businesses can reduce ambiguity in shipping disputes, document the condition of goods at each checkpoint, and increase trust with insurers and investigators.

They’re not only useful after incidents occur—they’re also preventative tools that deter bad actors and protect high-value shipments before issues arise.

How Tamper-Evident Tools Strengthen Your Insurance Claim?

Insurers expect solid evidence, especially when a claim involves high-value goods or potential tampering. Tamper-evident packaging helps meet that expectation. The following sections break down how these tools reduce doubt and support a stronger insurance claim process.

1. Provide Visual Proof of Package Integrity

Photos and videos showing intact tamper-evident seals offer immediate, visible confirmation that the shipment arrived in secure condition. This physical evidence helps identify the point of breach and defends against claims that the damage occurred before dispatch.

Such visuals are often used in legal proceedings and can help refute probable claims of fabricating physical evidence or presenting false evidence.

In criminal cases or an ongoing criminal investigation, this kind of proof may be requested by law enforcement officers, especially if tampering led to physical harm or violated an active insurance policy.

2. Create an Audit Trail with Seal Numbers or Scan Logs

Tamper-evident security labels and barcode scans generate a detailed audit trail that shows who accessed the package and when. This traceability is critical for resolving disputes quickly, especially when the handling route spans across multiple checkpoints or carriers.

When presented in an official proceeding, such data helps insurers and law firms identify the exact point of breach and assess responsibility. In fact, studies show that tamper-evident packaging markets are growing rapidly, with a forecasted CAGR of over 8% globally by 2034, driven by demand for such secure documentation.

3. Reduce Ambiguity in the Chain of Custody

Tamper-evident tools document every step a shipment takes, from warehouse to delivery. This prevents confusion over where the incident happened, especially when police officers, investigators, or a court need to determine intent or involvement in evidence tampering.

It reduces the risk that a person charged with mishandling can claim an invalid search or deny involvement. This clarity helps strengthen a case in front of an insurance company or court and prevents loopholes that might allow parties to avoid paying a valid insurance claim.

4. Strengthen the Case for Official Proceedings

When security seals are used correctly, they become a key element in claim acceptance. They give adjusters and legal teams confidence that the goods were tampered with after shipment, not before. This helps speed up decisions and reduces pushback from carriers.

If there’s a potential for felony charges due to theft or tampering, these tools also support a stronger case by showing intent and breach. In situations involving drug crimes, diverted goods, or suspected tampering, they provide a clear link in the legal proceeding without relying solely on testimonies or paperwork.

5. Support Compliance with Legal and Regulatory Standards

Tamper-evident tools help companies meet strict standards like ISO 17712, TAPA, and the Federal Anti-Tampering Act. These standards are critical during insurance investigations and criminal cases, especially when there’s a risk of a tampering charge or claims involving a criminal offense.

For an insurance company or law enforcement officers, tools that meet these standards help ensure the evidence holds up in official proceedings. This level of compliance also protects against evidence charges, especially in cases where a person alters packaging or claims are under review by investigators.

ROI: Cost of Tamper-Evident Tools vs. Cost of Denied Claims

The cost of tamper-evident tools is minimal compared to the losses from denied claims or legal disputes. Below is how they deliver real value in both prevention and recovery.

Cost of Implementation vs. Speed of Loss Recovery

For many businesses, the upfront cost of tamper-evident tools may seem like an added expense. But in reality, these tools are an essential part of risk control, especially when you consider the time and money lost during a disputed claim or a drawn-out investigation.

A missing seal or lack of traceability can leave your company exposed to liability, especially if an insurance company believes you failed to secure the shipment properly.

- Most basic void labels or seals cost less than $0.10 per unit.

- For medium-scale logistics, implementation costs can be recovered within one or two approved claims.

- Using these tools speeds up documentation, minimizes back-and-forth with adjusters, and avoids escalation into prosecution or evidence charges if claims appear staged or misleading.

Quick loss recovery can be the difference between maintaining coverage and triggering bad faith reviews. For high-risk categories, tamper-evident packaging may help prove chain-of-custody and avoid accusations of false evidence.

Preventative ROI for High-Value and Regulated Goods

In industries like pharmaceuticals, electronics, and food logistics, tamper-evident solutions are not just a benefit—they’re often a requirement under law. These sectors face higher stakes: a single compromised shipment can lead to fines, conviction, or product recalls.

Using tamper-proof tools helps deter evidence tampering and protects your company from being accused of misconduct or regulatory violations. Key benefits of preventative investment include:

- Lower likelihood of tampering-related felony charges or tampering charges if a breach occurs.

- Improved trust with insurance companies and investigators reviewing claims.

- Stronger position during legal disputes, especially when another party attempts to shift blame or destroy evidence.

- Demonstrated good-faith conduct, which can reduce liability and show that the business acted with reasonable precaution.

Prevention reduces the chance that a person involved in logistics will commit an act that triggers legal scrutiny. It also protects your brand from damage caused by loss or fraud claims.

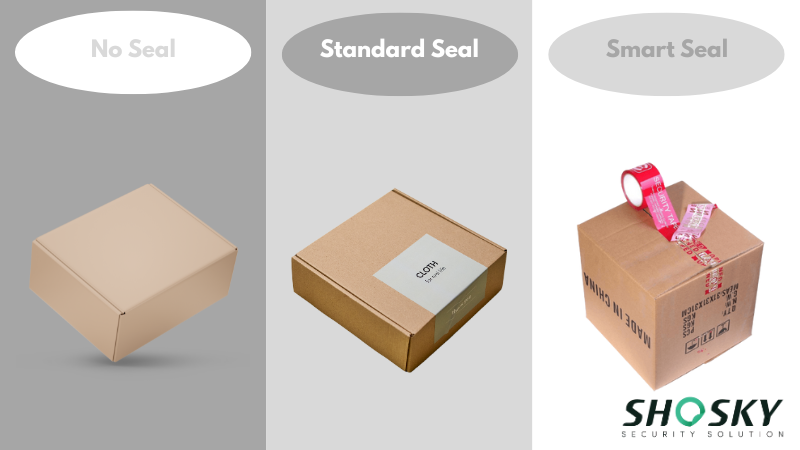

Cost Comparison: No Seal vs. Standard Seal vs. Smart Seal

To understand the value of tamper-evident solutions, it helps to compare their impact directly. Here’s a basic cost-benefit breakdown:

| Scenario | Approx. Cost Per Unit | Security Level | Risk Exposure |

|---|---|---|---|

| No Seal | $0 | None | High risk of tampering, hard to prove anything |

| Standard Seal/Label | $0.05–$0.15 | Medium | Visibly shows access, supports claim investigation |

| Smart Seal (QR/RFID) | $0.25–$1.00 | High + traceable data | Adds a digital trail, useful in prosecution or court |

Without tamper-evident tools, you rely on statements, shipping logs, and third-party reports—all of which can be challenged or dismissed during an official proceeding. Tamper-proof packaging becomes essential in defending against tampering charges, especially if witnesses or a law firm question when or where the breach occurred.

Real-World Use Cases

The use of tamper-evident packaging has helped real businesses prove liability and cut insurance losses. The following cases show exactly how.

Maersk Uses Snap-and‑Lock Seals to Prevent Evidence Tampering

Maersk worked with Tyden Group to secure its intermodal cargo shipments. They implemented snap-and-lock seals that can’t be reopened without showing visible damage. This made any sign of evidence tampering at handoff or loading points easy to detect.

The results were significant! Maersk reported fewer disputed claims and improved traceability across its shipping network. When an insurance company disputed a claim, Maersk could point to sealed containers and timestamps to demonstrate when and where the breach happened. This helped settle claims faster and avoid potential evidence-related challenges.

Union Pacific Enhances Railcar Security with High‑Security Seals

Union Pacific Rail Company, in partnership with a tamper-evident provider, began applying high-security bolt seals compliant with ISO 17712 on railcars transporting high-value or hazardous materials.

These seals resist tampering and show visible breakage, making unauthorized entry instantly evident and preventing potential criminal offense situations during transit.

Union Pacific’s internal audit found a drop in losses tied to theft and tampering, reducing insurance claim disputes across its insured cargo. The presence of documented seal usage strengthened evidence admissibility in official proceedings. It also deterred actions by anyone aware that tampering attempts would be obvious and traceable.

FAQs

Can tamper-evident seals be used as legal evidence?

Yes. If applied properly, they provide physical proof that can support claims and show signs of evidence tampering.

What’s the cost vs. savings in claim acceptance?

Tamper-evident tools are low-cost compared to denied claims or legal disputes. They reduce delays, support faster claim acceptance, and help avoid charges like false evidence or bad faith.

Can tamper-evident tools be customized per shipment?

Yes. Labels, tapes, and seals can be serialized, color-coded, or branded for specific routes or cargo.

Conclusion

Tamper-evident solutions give you clear, visual proof to support your insurance claims and defend against disputes. For high-value or regulated goods, it’s not just a precaution—it’s a smart investment. So, don’t wait for a denied claim to act. Strengthen your shipments, protect your coverage, and make each claim easier to prove from the start!

Simplify the Insurance Claims with Shosky Security’s Tamper-Evident Solutions

Protect your goods and simplify the insurance claims process with tamper-evident packaging from Shosky Security! From void labels to high-security seals, our tools help you spot tampering early and prove it clearly when it counts. Contact us now to get started with a tailored solution!