Cash-related frauds cost businesses millions annually. This significant financial burden highlights the critical need for robust security measures in cash-handling processes. One of the most effective but often overlooked solutions is the use of a secure, tamper-evident deposit bag.

Tamper-evident deposit bags are designed specifically to address cash-related risks. In this article, we will explore how to safeguard cash and prevent fraud using deposit bags. We will also cover how to choose the right deposit bag, properly pack and seal it, and securely transport and track it to minimize risks and maximize security.

What is a Deposit Bag?

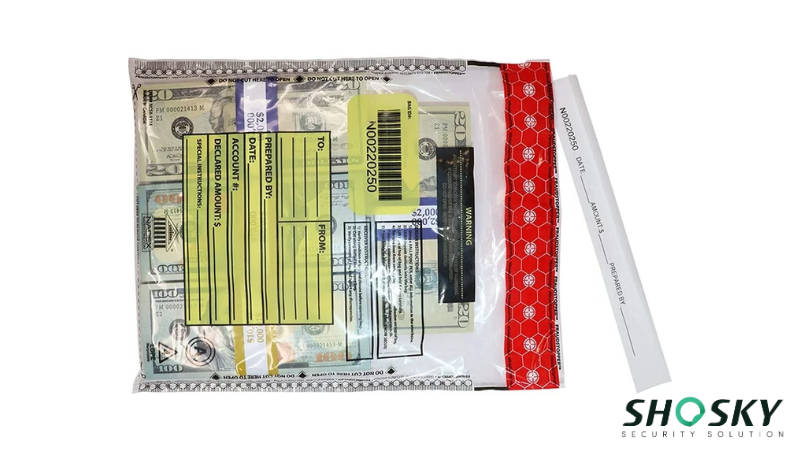

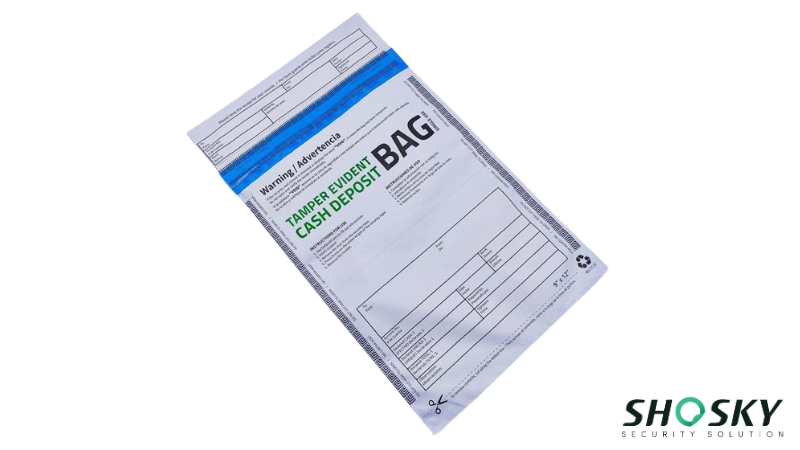

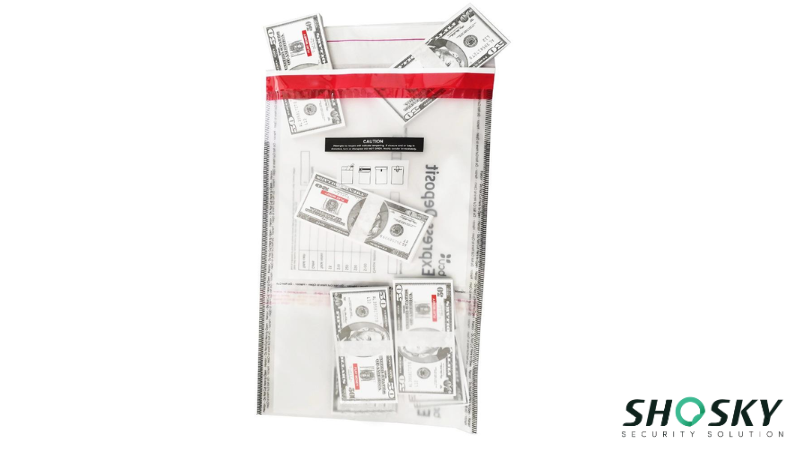

A deposit bag is a secure bag used by businesses or individuals to safely store and transport cash. These bags typically feature tamper-evident seals, adhesive closures, and unique serial numbers to help maintain the integrity of the contents and prevent unauthorized access. Commonly used deposit bags include:

- Plastic Deposit Bags: These basic, lightweight bags are suitable for businesses handling smaller amounts of cash or checks.

- Tamper-Evident Deposit Bags: The industry standard for cash handling and fraud prevention, these tamper-evident bags feature seals or adhesives that show visible signs of tampering, making them ideal for businesses with larger cash sums or sensitive items.

- Custom Deposit Bags: Custom bags are tailored to a business’s needs with unique sizes, materials, and branding.

As businesses deal with large volumes of transactions daily, especially those involving cash, the need for high-quality, secure deposit bags has grown significantly in recent years.

How Secure Bank Deposit Bags Help: Key Benefits

Secure and efficient cash management is a challenge for many businesses. Deposit bags offer a powerful solution, providing enhanced security, peace of mind, and streamlined auditing for companies handling cash, checks, or sensitive documents. Here’s how they deliver crucial advantages:

1. Enhanced Security: Deterring Theft and Fraud

Deposit bags are specifically designed to prevent unauthorized access and tampering during transit. Security tamper-evident bags, for example, feature advanced seals that clearly indicate if an attempt has been made to access the contents. This provides a forensic trail, making it much harder for thieves or dishonest individuals to go undetected.

This level of protection ensures that funds, checks, or sensitive items remain safe while being transported to the bank or any designated location. Businesses can rely on tamper-proof designs to deter theft and reduce fraud risks, safeguarding their assets throughout the deposit process.

For instance, according to the 2023 National Retail Federation’s National Retail Security Survey, retail shrinkage from theft, including employee theft, accounted for $112 billion in losses. The use of robust internal controls, such as tamper-evident packaging, is a key strategy for mitigating this significant financial burden.

The clear visual evidence of a compromised seal acts as a strong deterrent and an undeniable forensic trail, making it much harder for thieves or dishonest individuals to go undetected.

2. Peace of Mind for Employees and Employers

Knowing that valuables are protected is invaluable. Secure deposit bags provide confidence to employees tasked with handling cash or making bank deposits. The durable and tamper-evident features reassure employees that the funds they transport are protected, minimizing personal risk and stress.

For employers, this translates into confidence that cash will arrive intact at its destination. This added layer of security fosters a sense of accountability and reduces the stress associated with cash handling, and ultimately contributes to a more secure and trusting work environment for everyone involved.

3. Easier Audits and Streamlined Record-Keeping

Imagine a bustling restaurant with 10 cashiers. By using sequentially numbered deposit bags, the manager can instantly trace any discrepancy back to a specific cashier and shift, reducing investigation time from hours to minutes.

Deposit bags simplify audits by offering a clear and documented trail for each deposit. Many bags include features like:

- Barcodes: For quick scanning and automated system updates.

- Sequential Numbering: Providing a unique identifier for every bag, making it easy to cross-reference with deposit slips and bank records.

- Writable Sections: For manual labeling of bag contents, deposit details, and employee initials.

These features make it remarkably easy to track deposits, verify amounts, and maintain accurate records, reducing errors and ensuring compliance during audits. Businesses can streamline their financial processes with organized and efficient record-keeping enabled by high-quality deposit bags.

How to Choose the Right Tamper-Evident Deposit Bag for Your Business?

Choosing the right deposit bag is crucial for ensuring the security of your business’s cash and valuables. In this section, we’ll discuss the key factors to consider when selecting a bank deposit bag, including security features, bag size, durability, and cost.

Step 1: Assess Your Unique Needs

Before you start shopping, take some time to thoroughly assess your specific requirements. This crucial first step will help you narrow down your options and choose the most suitable bag. Consider the following:

- Daily Cash Volume: How much cash and how many checks do you typically handle in a day or per deposit? This will dictate the bag’s necessary capacity and size.

- Security Concerns & Risk Profile: What are your primary security concerns? Are you handling high-value items, highly sensitive documents (e.g., patient records for HIPAA), or large quantities of cash? Is internal or external theft a bigger concern? Consider whether you need protection against employee theft or external threats during transport.

- Transportation Method: How will the bags be transported? (e.g., armored car, employee personal vehicle, public transit). This directly impacts the required durability and security level of the bag.

- Budget: Tamper-evident deposit bags range in price depending on their size, material, and security features. Establish a budget upfront, but remember to consider the long-term cost of potential losses from theft or fraud versus the investment in a more secure bag.

- Regulatory Compliance: Are there any specific industry regulations (e.g., Controlled Substance Accountability for pharmacies, PCI DSS for retailers) or bank requirements for cash handling and deposit procedures that you need to meet?

Once you have a clear idea of the most suitable material for your deposit bags, the next critical step involves focusing on the specific security features. These attributes provide additional layers of protection, ensuring the integrity of your contents from the moment they are sealed until they reach their destination.

Step 2: Select the Right Material

Once you have determined your needs, selecting the right material is the next step. The material of bank deposit bags directly affects their durability, resistance to tampering, and overall security. Here are some common materials used for deposit bags:

- Polyethylene Plastic: Lightweight and cost-effective, suitable for lower cash volumes or situations with minimal risk. Often used for single-use, disposable bags that still incorporate a tamper-evident seal.

- Reinforced Plastic (e.g., multi-layer co-extruded films): Offers enhanced tear and puncture resistance. Ideal for higher cash sums or deposits that might undergo more handling during transit.

- Vinyl or Nylon: More durable and often reusable options, suitable for very high volumes or for transporting sensitive documents that require repeated use of the same bag. These may incorporate more sophisticated locking mechanisms and a clear tamper-evident window for a one-time-use seal.

If you handle lower cash volumes and don’t face high risks, lightweight options like polyethylene plastic may suffice. However, for larger sums or higher-risk situations, stronger materials such as reinforced plastic, vinyl, or nylon might be necessary.

Step 3: Choose Security Features

Once your basic material is selected, focusing on the specific security features is paramount. Several options can significantly enhance the protection of your cash and checks, allowing you to prioritize them based on your business’s unique risk assessment.

| Security Feature | Description & Benefit |

|---|---|

| Tamper-Evident Seals | Designed to visibly indicate any unauthorized access; may change color, display "VOID," or tear if tampered with. Crucial for high-security. |

| Adhesive Closures | Strong adhesives prevent easy opening; some bags feature double strips or locking mechanisms for enhanced protection. |

| Unique Serial Numbers/Barcodes | Allow for easy tracking and verification of each bag, reducing errors or fraud; especially important for high deposit volumes. |

| RFID Blocking | Material prevents electronic theft of data from cards or other RFID-enabled items within the bag, safeguarding sensitive information. |

Incorporating these features provides robust protection, ensuring that your valuables remain secure from the moment they are packed until they reach their destination. Choosing the right combination directly impacts the integrity and peace of mind associated with your cash-handling processes.

Step 4: Consider Size and Capacity

The size and capacity of the bag should directly correlate with your daily cash volume. Choose a bag that comfortably accommodates your typical deposits without being overly large (which could compromise security) or too small (which could lead to damage).

Measure your typical cash and check volume to determine the appropriate dimensions. Many manufacturers provide size charts and specifications to assist with this.

Step 5: Check for Compliance

Depending on your industry and location, there may be specific regulatory requirements for cash handling and deposit procedures.

Check with your local authorities or industry associations to ensure your chosen bank deposit bags comply with all relevant regulations. This might include requirements for specific security features, labeling, or tracking methods. Non-compliance can result in penalties.

Remember to always prioritize security when handling cash and valuable documents. Investing in the right deposit bag is a critical step in a comprehensive fraud prevention strategy.

How to Use Deposit Bags for Maximum Security?

Now that you’ve selected the right deposit bag for your business, the next crucial step is ensuring it is used to its full security potential. Proper handling and attention to detail will minimize the risk of tampering or theft and guarantee that your deposit reaches its destination securely.

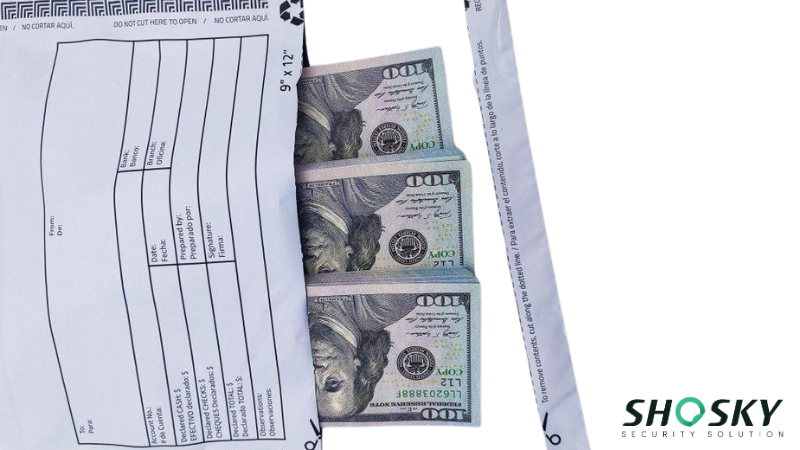

Pack Cash or Checks Securely

To pack your cash or checks securely, here are some things to keep in mind:

- Organize Contents: Start by organizing your cash by denomination, securing stacks with bands. Place endorsed checks face-up in numerical order. Keep deposit slips separate but easily accessible.

- Avoid Overfilling: Gently place the items in the deposit bag without overfilling. Overstuffing can stress the bag material and compromise the seal.

- Even Distribution: Distribute the weight evenly to avoid strain on one section of the bag. If adding other documents, keep them separate from cash and checks to prevent damage to currency.

With your contents now meticulously organized and carefully placed within the bag, please remember to carefully check the cash or checks you packed before sealing the bag.

Seal the Bag Correctly

Properly securing the tamper-evident seal is critical. The method will vary slightly depending on the type of seal used, but the principle is the same: ensure a complete and irreversible seal. Here’s a quick checklist for proper sealing.

Do:

- Do: Check that the bag’s sealing surface is clean and dry.

- Do: Firmly press the adhesive strip to ensure a complete, tight seal.

- Do: Carefully inspect the seal for any gaps, bubbles, or loose areas.

Don’t:

- Don’t: Stretch the bag material while sealing, as this can compromise the adhesive.

- Don’t: Overstuff the bag, which can cause stress on the seal.

The tamper-evident bag tape as a seal is the first line of defense against theft or tampering. Before sealing, inspect the bag to ensure the seal is intact and functioning properly. Follow the manufacturer’s instructions carefully to seal the bag correctly, making sure there are no loose edges or gaps. Don’t rush through this step, as a secure seal is crucial for ensuring the safety of the contents.

Scenario: A manager at a multi-location fast-food chain noticed a 5% cash discrepancy at one location. The security protocol required sealing all deposit bags with a unique serial number. Upon investigation, they found an unsealed bag at the end of a shift, with the serial number not logged. This allowed them to quickly narrow down the source of the loss, preventing a prolonged investigation and reinforcing staff accountability.

Label the Bag Clearly

Once the bag is sealed, it’s important to label it clearly with key information using a permanent ink marker. This ensures easy identification and accurate record-keeping.

Mandatory Information:

- Date: The deposit date.

- Account Number: Your account number.

- Amount: Total deposit amount (numerically and in words).

- Company Name (if applicable): Your business name.

- Additional Details: Any other relevant information required by your bank or internal accounting procedures (e.g., teller ID, department).

Utilize Pre-Printed Areas: Use the pre-printed sections or writable areas on the bag. This standardized approach reduces errors.

You can also use the pre-printed sections or writable areas on the bag to provide this information.

Keep the Bag Sealed During Transit

After sealing the deposit bag, do not reopen it under any circumstances until it reaches its destination. Store the bag in a secure location, such as a locked safe or a secure transport vehicle. This minimizes the risk of theft or loss during transit.

The bag should remain in its sealed condition throughout the journey. Once delivered, it should be opened only by authorized personnel at the designated location (e.g., bank teller, vault manager), ensuring complete integrity of the contents throughout the process.

Use Secure Deposit Methods

When transporting the deposit bag to the bank or another secure destination, it’s essential to choose a reliable and safe transportation method. For valuable assets, armored vehicles or dedicated courier services offer the highest level of security.

If using internal staff, ensure they are thoroughly trained in secure cash-handling protocols, including varying routes, avoiding routine, and maintaining discretion.

Always ensure that you receive confirmation of the bag’s receipt by obtaining a signature or other acknowledgment from the recipient (e.g., a bank deposit slip with a timestamp). This not only ensures the bag’s safe delivery but also provides a vital record for accountability and financial tracking.

Common Mistakes to Avoid When Using Tamper-Evident Deposit Bags

While bank deposit bags or bank deposit pouches are designed for security, certain errors can compromise their effectiveness. Avoiding these mistakes ensures maximum protection and streamlines the deposit process.

Mistake 1: Improper Sealing or Labeling

Issue: Failing to seal the bag properly or not fully activating the tamper-evident feature can leave it vulnerable to tampering without leaving a trace. Neglecting to label the bag clearly (or using non-permanent ink) can lead to confusion, errors during audits, or difficulty in tracing.

Solution: Always ensure the tamper-evident seal is fully activated and intact, with no gaps or bubbles. Double-check all labels for legibility and accuracy before the bag leaves your custody.

Mistake 2: Using the Wrong Size or Type of Bag

Issue: Selecting a bag that is too small for the deposit can lead to overstuffing, which may stress seams, cause tearing, or prevent the seal from fully engaging. Conversely, an oversized bag can make contents shift excessively, potentially causing damage, or make handling cumbersome.

Solution: Match the bag’s size and security features to the specific volume and type of deposit (cash, coins, checks, sensitive documents) and your risk assessment.

Mistake 3: Failure to Track and Audit Bags

Issue: Not keeping meticulous records of each bank deposit bag (e.g., serial numbers, contents, date sealed, who transported it, who received it) can create significant issues during audits or investigations of discrepancies.

Solution: Utilize bags with features like unique serial numbers or barcodes to maintain a reliable, systematic tracking system. Regularly audit the entire deposit process to ensure compliance, accountability, and the effectiveness of your security protocols.

FAQs

Can deposit bags be reused?

While some bank deposit bags are designed for one-time use, reusable plastic bags are available. But they still need to be tamper-evident to ensure security.

How do I choose a secure payroll deposit bag?

Look for tamper-evident seals, durable materials, and the right size to hold cash or checks securely.

Are plastic deposit bags durable enough for frequent use?

Yes, high-quality plastic bags are sturdy enough for frequent handling and provide reliable security.

Conclusion

Deposit bags are an essential tool for securing cash and minimizing fraud risks. They are a critical step in a comprehensive fraud prevention strategy. To reduce fraud risk, streamline operations, and maintain accurate records, choosing the right tamper-evident bag is key.

By ensuring proper selection, sealing, and tracking, you can enhance security, protect your assets, and foster trust among employees and stakeholders.

Handle Your Cash with Confidence: Choose Shosky Security!

Shosky Security specializes in making premium tamper-evident deposit bags. With advanced features and customization options, we help businesses safeguard their assets and prevent fraud. Contact us today to learn more about our products and secure your cash-handling processes effectively!