Managing cash flow is one of the most critical aspects of running a successful retail business. Still, many small business owners overlook the importance of secure cash-handling procedures. Daily deposits, weekend receipts, and after-hours earnings all require safe transportation from your store to the bank.

Because without a proper system in place, the chances of theft, errors, or insurance disputes rise fast. And that is where strong tamper-evident retail deposit bags can make a big difference. These bags do more than hold money. They help you track transactions, reduce risk, and improve how your store manages its daily cash flow. This article breaks down how you can use deposit bags more effectively.

What Are Retail Deposit Bags?

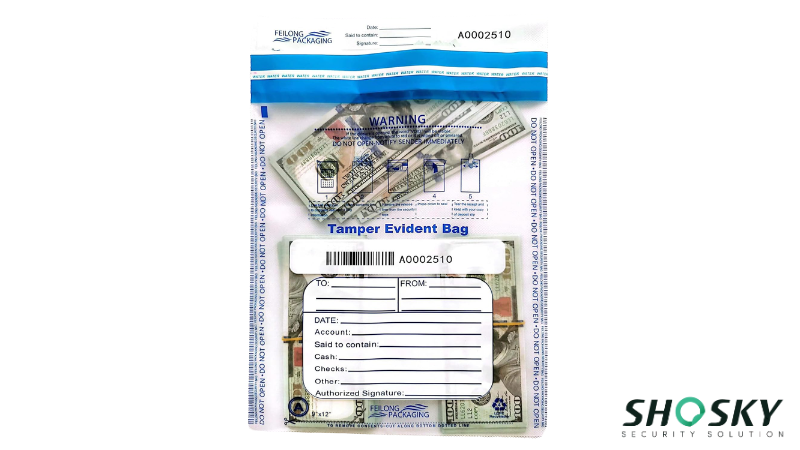

Deposit bags are specialized tamper-evident bags used to safely transport money and related documents from your store to the bank. These bags come equipped with tamper-evident features like tamper-evident security bag tape, sequential numbering, and durable construction that makes unauthorized access immediately visible.

Small retailers use these bags at the end of each business day or during shift changes. These bags are also essential when businesses prepare bulk cash deposits for the bank or hand off daily receipts to armored car services for transport. Whether you manage one register or several, cash bags offer a consistent, secure way to handle money across your store.

The need for secure handling is real. According to the 2022 National Retail Security Survey, cash theft and employee fraud were among the top five contributors to retail shrinkage. The survey report recommends stronger physical security for cash handling.

So, using proper deposit bags isn’t just a best practice—it’s a direct response to growing risks that can impact your business’s bottom line.

Key Features and Benefits of Retail Deposit Bags

Not all deposit bags are made equal. For small businesses, the right bag doesn’t just store money—it helps prevent theft, keeps staff accountable, and speeds up the deposit process at the bank. Understanding both the essential features and the significant benefits will highlight why these bags are a crucial upgrade for your cash handling.

Here are some essential features of deposit bags that enhance protection and streamline operations:

- Tamper-Evident Seals: Specialized adhesive closures reveal clear, irreversible “VOID” messages if opened, indicating unauthorized access.

- Unique Serial Numbers & Barcodes: Each bag features distinct identifiers for precise tracking and accountability.

- Sequential Numbering: Bags are ordered in numbered batches to help track every deposit.

- Tear-Resistant Material: Durable plastic withstands handling and resists tearing, protecting contents.

- Write-On Areas: Dedicated spaces allow for essential information like date, amount, and account details.

- Reinforced Seams: Strengthened seams prevent splitting, further securing contents.

- Puncture Resistance: Bags offer a degree of resistance against punctures for added protection.

Clear deposit bags can help banks verify contents quickly, while opaque ones offer more privacy. The right combination of features helps reduce errors, protect cash, and streamline your store’s cash handling from end to end.

These crucial features work together to provide several distinct advantages for your business:

Tamper-evident deposit bags help prevent internal theft by clearly showing if a bag has been opened. When sealed and logged correctly, they create a clear chain of custody. This boosts staff accountability and protects both cash and valuables during daily handling.

They also improve the accuracy of bank deposits. Bags with barcodes or tracking numbers allow banks to process money faster and reduce errors. For stores making frequent drops, this means less time spent correcting mistakes and more control over every item moved.

Furthermore, many insurance providers and banks expect secure handling procedures. Using tamper-evident bank deposit bags helps meet those standards and reduces liability. If you’re ever asked to show proof of proper cash handling, these bags give you the records to back it up.

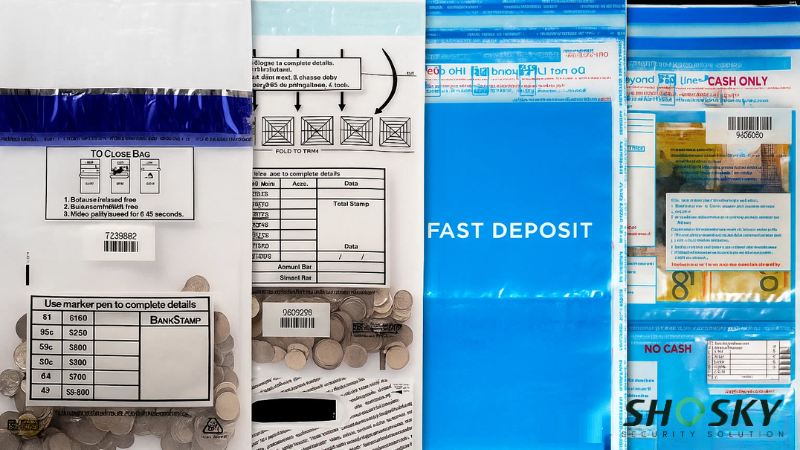

Types of Deposit Bags for Small Businesses

Small businesses have different cash handling needs, so there’s no one-size-fits-all solution when it comes to deposit bags. Below are the most common types of deposit bags, each with its own benefits depending on how your store operates.

Single-Use Tamper-Evident Bags

Single-use tamper-evident bags are designed for one-time use. Once sealed, they cannot be opened without showing clear signs of tampering. These are ideal for retail stores, cafés, or service counters that prepare daily cash deposits or shift-end drops. They’re lightweight, affordable, and often used in large quantities for smoother daily operations.

Each bag comes with a unique tracking number, seal strip, and often a writable surface for logging amounts and details. Businesses that rely on fast turnover and minimal storage often prefer this option due to its simplicity and strong security features.

Reusable Locking Deposit Bags

Reusable deposit bags are built for repeated use and typically feature a zipper and locking mechanism. These are well-suited for small businesses that partner with armored services or for situations where cash is transported in bulk. The upfront cost is higher, but the long-term value comes from repeated use and added durability.

They’re often made from tough materials like nylon or heavy-duty vinyl, making them resistant to wear and tear. This type is a good choice if your store manages large cash volumes or if you prefer a more structured, trackable cash handling routine.

Clear vs. Opaque Bags

Clear deposit bags allow the contents to be visible, which helps banks speed up verification during the deposit process. They’re great when accuracy and time are priorities, especially for stores making frequent drops. Clear bags are often used when currency, coins, or receipts need to be quickly identified without opening the bag.

On the other hand, opaque bags are designed for privacy. They conceal the contents, making them ideal for businesses concerned about discretion, such as restaurants, casinos, or shops located in high-traffic areas. Some bank deposits also require opaque bags to meet their handling policies.

Custom-Printed Deposit Bags

Custom-printed deposit bags help with branding and internal organization. Many small businesses print logos, color codes, or department names on their bags to avoid confusion and make cash tracking easier. This is especially helpful for businesses with multiple tills, store sections, or daily shifts.

Aside from brand visibility, custom printing also adds a layer of professionalism and accountability. It can support internal tracking systems or even help customers feel more confident about how your cash handling is managed behind the scenes.

Comparison Table: Deposit Bag Types for Small Businesses

Now, here’s a table that breaks down the most common types of deposit bags used by small businesses. It’ll help you compare features at a glance and choose what fits your daily cash handling needs.

| Bag Type | Key Features | Best For | Reusable? |

|---|---|---|---|

| Single-Use Tamper-Evident | Tamper seals, writable panels, barcodes | High turnover stores, small retailers | No |

| Reusable Locking | Lockable zipper, heavy-duty material, ID windows | High-cash-volume stores, service-based businesses | Yes |

| Clear Bags | Transparent, barcode tracking, seal strip | Businesses needing speed and accuracy | Depends |

| Opaque Bags | Conceals contents, writable, tamper-evident | Cafés, casinos, restaurants | Depends |

| Custom-Printed | Printed logo/labels, color-coded, barcode optional | Multi-till shops, branded retail chains | Optional |

Whether you need speed, added privacy, or long-term durability, the right choice can improve both cash security and workflow. Make sure to match the bag type with your store’s deposit routine for the best results.

How to Choose the Right Deposit Bag for Your Retail Store

Not every business handles money the same way. A small café might only need a single pack of plastic deposit bags for end-of-day drops, while a convenience store may need to order bags in bulk for each shift. Therefore, it’s necessary to select the right deposit bags based on your specific needs.

When choosing the right deposit bag for your retail store, consider:

- Cash volume: Match the bag size and strength to the amount you handle.

- Tamper-Evident Features: Look for seals or strips that clearly show any unauthorized opening, providing vital security.

- Tracking & Accountability: Prioritize writable panels, barcodes, or features that align with your shift-based operations for easy logging and management.

- Material & Durability: Choose tear-resistant, puncture-proof materials that can withstand daily use and moisture. Consider if you need the long-term durability of reusable bags.

- Size & Capacity: Match the bag’s size and strength to your typical cash volume, ensuring it fits securely into safes and deposit slots.

- Supplier Reliability: Select trusted providers to avoid delays and ensure consistent supply.

Don’t just go for the cheapest prices; compare deals that balance cost, quality, and delivery times.

How Small Retailers Use Deposit Bags Effectively

Even the best bag won’t help if your system is sloppy. Small businesses can improve their cash handling by setting up solid procedures and using bag features properly.

1. Set Clear and Secure Deposit Procedures

Cash payments still account for 14% of all transactions in the U.S. in 2024, making secure deposit procedures essential for small retailers. Establishing tamper-evident protocols helps protect valuables while ensuring consistent tracking of all items that enter the banking system.

Proper implementation requires training workers to use security features correctly and maintain detailed logging systems for all bank bags. When employees understand how to find and document security breaches, they can commit to safety protocols and provide secure handling of cash and other valuables.

Essential security procedure elements include:

- Implement dual-control verification for all high-value deposits and cash handling

- Establish written protocols for tamper-proof cash bags inspection and documentation

- Create secure storage areas for filled bags awaiting transport to banking facilities

- Schedule regular audits to ensure compliance with established security standards

2. Apply Best Practices from Real Retail Scenarios

The global cash transport security bags market is projected to expand from USD 462.18 million in 2024 to USD 725.77 million by 2034. Real-world examples show how smart cash handling can reduce risk. So, small businesses are increasingly interested in customized solutions that match their specific operational needs, from barcoded tracking systems to location-specific identification features.

Convenience stores, boutique shops, and cafes each face unique challenges in cash management, requiring different approaches to the utilization of tamper-evident cash bags. The range of available solutions allows retailers to find systems that integrate seamlessly with their existing stock management and financial processes.

Proven implementation strategies from retail scenarios:

- Convenience stores: Use barcoded bags for each shift

- Boutiques: Use printed bags to label the team or the till

- Cafés: Schedule daily deposit times to reduce missed drops

- Restaurants: Lock filled bags in safes after closing

3. Optimize Bag Features for Business Efficiency

The right product makes a real difference. Cash bags come in many sizes and materials. Match these to your store’s needs. A mismatched cash deposit bag solution slows things down. So, optimize bag features for business efficiency.

Optimization involves selecting the right combination of size, labeling capabilities, and security features to match daily cash flow patterns. The final product should accommodate peak transaction periods while remaining cost-effective during slower business cycles.

Key optimization factors for maximum efficiency include:

- Choose bag sizes based on your daily cash total

- Use writable panels to log staff, date, and amount

- Label bags by shift, team, or department

- Compare different styles before you buy in bulk

Strong deposit bag use starts with strong systems. When small retailers combine the right bag features with clear protocols and real-world best practices, they gain better control over their cash handling. It’s not just about security—it’s about making daily operations smoother, faster, and more reliable from start to bank drop.

FAQs

Can deposit bags be customized with logos or tracking info?

Yes. Many suppliers offer printed logos, barcodes, and even color coding for different departments or shifts.

Are deposit bags fireproof or waterproof?

Most are water-resistant but not fully fireproof. If you need fire protection, ask for specialty bags or use a secure fire-rated container.

How long can you store sealed deposit bags?

You can store sealed bags for a few days, but most banks recommend depositing daily to reduce risk.

Conclusion

Running a retail business means staying in control of your cash from start to finish. Tamper-evident cash deposit bags give small businesses a simple, proven way to protect cash, receipts, and other valuables. They also help you reduce theft, improve accuracy, and keep your team accountable. So, don’t wait for a mistake to happen—upgrade your deposit system before it costs you more.

Simplify Cash Management with Shosky Security’s Retail Deposit Bags

Thousands of small businesses count on Shosky Security for dependable retail deposit bags. Our products are designed to handle everything from quick cash drops to high-volume bank runs. Contact us and get your next deposit bags!