Handling cash and sensitive documents without the right deposit bag is a risk many businesses still take. From internal shrinkage to lost audit trails, the consequences can be serious. According to the 2024 ACFE Report to the Nations, cash theft accounted for 42% of asset misappropriation cases, many linked to poor handling procedures.

Tamper-evident bank deposit bags are designed to fix that. But not every bag offers the same protection. Some tear under weight, others fail to seal properly, and many don’t support audit tracking. This guide helps you avoid those problems by choosing the right material, size, and security features for your needs.

What Is a Bank Deposit Bag and Who Needs One?

A bank deposit bag is a specialized tamper-evident bag used to transport cash, checks, deposit slips, or documents securely from one point to another. While the name points to banks, these bags are used far beyond the financial sector.

Industries that rely on deposit bags include:

- Retail for daily cash drops, shift handovers

- Hospitality for bar and restaurant end-of-day collections

- Logistics for internal or third-party cash-in-transit (CIT)

- Education for fee collection, donations, and event money

- Nonprofits for field donations or community collections

Without tamper-proof bags, businesses often deal with missing contents, unclear audit trails, and compliance breaches. A joint study by NRF and the University of Florida in 2022 found that retail shrinkage rose to 1.6% of total sales, with employee theft being the biggest driver, often through unsecured deposit practices.

Materials Used in Bank Deposit Bags

The material choice affects everything from cost to compliance. There are different types of materials used to make bank deposit bags. Here’s a detailed analysis of each:

Plastic Deposit Bags

Plastic deposit bags represent the most widely adopted single-use option in today’s market. These bags typically feature tamper-evident closures that provide clear visual indicators when someone attempts to compromise the security. Their lightweight design makes them cost-effective for high-volume operations where reusability isn’t a priority.

The gauge of plastic used varies significantly, with thicker materials offering superior protection against punctures and tears. Most plastic bags include writable panels for easy identification and tracking purposes, while maintaining their tamper-evident properties.

Fabric/Nylon Deposit Bags

Fabric and nylon deposit bags offer superior durability for businesses requiring reusable solutions. These bags feature water-resistant properties and lockable mechanisms that provide enhanced security for valuable contents. Their robust construction makes them ideal for armored car services and internal cash handling operations.

The heavy-duty design of fabric bags allows them to withstand harsh conditions while maintaining tamper-proof properties. Many features reinforced the sides and bottom panels for additional protection against physical damage and environmental factors.

Poly/Clear Film Bags

Clear film bags provide transparency advantages that allow for quick visual inspection of contents without opening the bag. Retail businesses frequently use these bags for drop-off operations where bank personnel need to verify contents efficiently.

The clear material doesn’t compromise security features, as these bags still include tamper-evident bag tapes and other protective measures. This combination of visibility and security makes them particularly valuable for high-traffic banking environments.

Material Comparison Analysis

The table below gives a quick snapshot of key features so you can pick the most practical option.

| Material Type | Durability | Reusability | Cost | Best Use Case |

|---|---|---|---|---|

| Plastic | Medium | Single-use | Low | High-volume retail |

| Fabric/Nylon | High | Multi-use | Medium | Armored transport |

| Clear Film | Medium | Single-use | Low | Quick inspection needs |

While plastic and clear film bags keep costs low for daily use, fabric or nylon bags offer long-term value for secure transport needs. Always match the material to the frequency of deposits, the level of security required, and the handling conditions.

Standard Sizes for Bank Deposit Bags

Using the wrong size can lead to overstuffing, tearing, or empty space that wastes costs. The size you choose depends on the amount and type of items you’re transporting – cash, coins, checks, or paperwork. Here is a detailed analysis of various sizes of bank deposit bags.

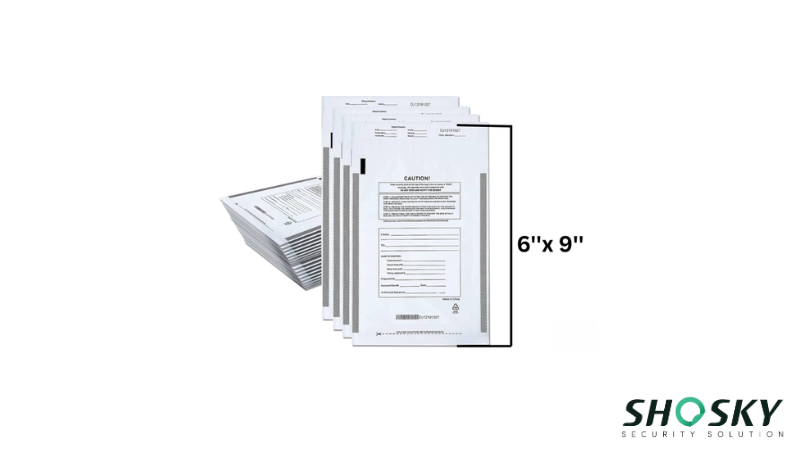

Small Size Bags (6″ x 9″ to 9″ x 12″)

Small-sized bags are ideal for light daily use. They’re often used by:

- Independent retailers

- Cafes or food trucks

- Local service providers

These bags hold cash, checks, receipts, and coins from a single register or shift. They’re compact enough to fit in lockboxes or safes without taking up space.

They’re usually clear or semi-transparent, helping verify contents at a glance. Some also come with pre-printed receipt pouches or writable panels for internal tracking. Because they use less material, they’re also a smart option for keeping costs low.

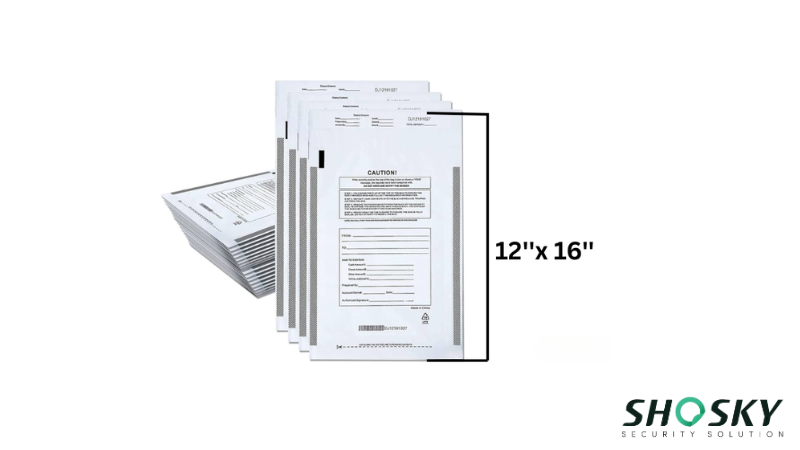

Medium Size Bags (12″ x 16″)

Medium-sized bags are the most versatile. They offer the best balance between space and portability. You’ll often find them used by:

- Multi-register retail stores

- Chain restaurants

- Medical or dental offices handling client payments

These bags comfortably hold multiple bundles of cash, deposit slips, and checks. They’re often designed with double-sealed edges and tamper-evident closures for added security.

Some models come with barcoded tracking zones and reinforced seams to prevent accidental tearing. If your daily orders include various items or documentation, medium bags help keep everything in one place, well-organized, and safe.

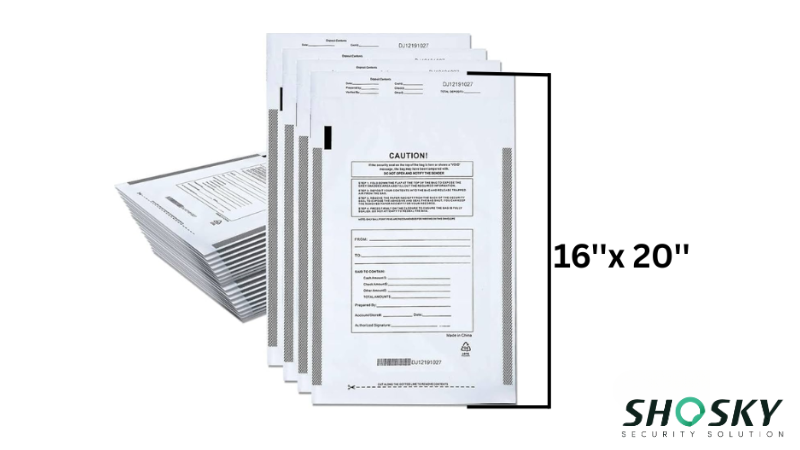

Large Size Bags (16″ x 20″ and above)

Large deposit bags are designed for heavy-duty use. These are most often used by:

- Supermarkets

- Department stores

- Courier services handling high-volume bank deposits

Large bags can store bulk coins, large sums of cash, or batches of end-of-day paperwork. Most are made with thicker gauge plastic or heavy-duty fabric, reducing the risk of rips under weight. Some include built-in pouches for labeling or chain-of-custody forms.

If you’re transporting multiple registers’ contents or high-volume packs, large bags are the reliable choice. Just ensure the quantity you move justifies the size, so you’re not wasting materials or space.

Essential Features to Look for in High-Quality Deposit Bags

Your choice of features affects both safety and speed. Here’s what to look for in a reliable, high-performance deposit bag:

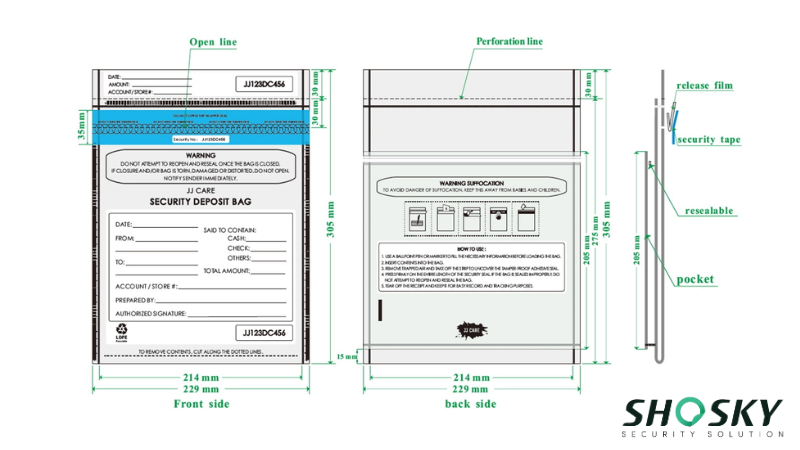

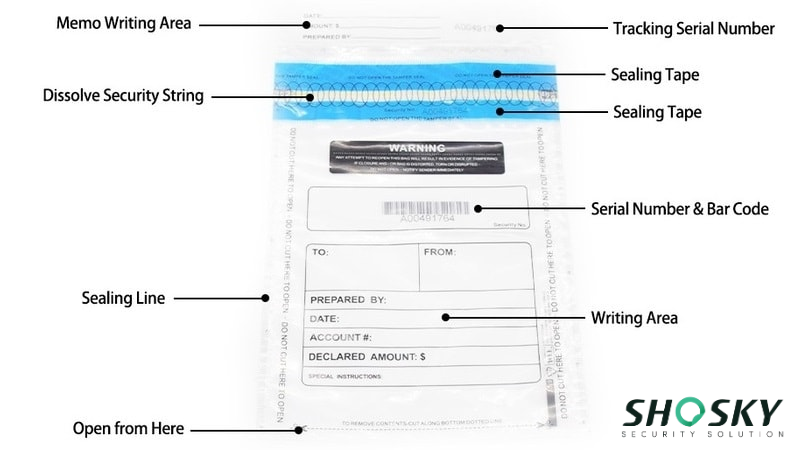

1. Tamper-Evident Seals and Indicators

A quality bag should have multiple tamper technologies features, including void patterns, color-changing adhesives, and sequential numbering systems.

The security closure should activate immediately upon sealing and provide irreversible evidence of any tampering attempts. Look for bags that display “VOID” or “OPENED” messages when someone tries to compromise the seal.

2. Writable Panels and Tracking Options

Professional bank deposit bags include designed areas for recording essential information such as:

- Date and time of deposit

- Contents summary and quantity

- Responsible party signature

- Account number or reference codes

Some advanced bags feature barcode zones that integrate with tracking systems for enhanced chain-of-custody documentation.

3. Locking Mechanisms and Security Options

Different locking options serve various security levels and operational needs. Basic bags use adhesive closures, while premium options include zip-lock mechanisms, security ties, or even keyed locks for maximum protection. The choice depends on your specific security requirements and user training levels.

4. Custom Printing and Branding Opportunities

Many businesses benefit from custom printing options that include company logos, specific instructions, or color coding systems. Custom features help streamline operations and reinforce professional branding during banking interactions while maintaining security standards.

5. Tear-Resistant and Durable Materials

The material of the bag plays a key role in keeping the contents secure. High-quality deposit bags use multi-layer polyethylene or co-extruded plastic that resists tears, punctures, and moisture. These materials protect against rough handling during transport and reduce the risk of accidental spills or tampering.

Compliance and Security Considerations

The right deposit bag isn’t just about tamper-proof features; it’s also about meeting strict compliance needs. No matter your state, you must view your compliance risks and choose bags accordingly. The following section breaks down the key security and regulatory elements to help you choose bank deposit bags that meet both internal protocols and external regulations.

Regulatory Requirements

Banks’ segment dominated the market in 2024 due to the increasing adoption of digital transformation strategies within financial institutions seeking to enhance operational efficiency. This trend emphasizes the importance of security compliance in all cash handling operations.

Banking regulations and industry standards require specific security measures for cash transport operations. Many institutions mandate the use of tamper-evident bags that meet established compliance criteria for armored car services and internal transfers.

Audit Trail Requirements

Proper audit trails depend on bags that provide clear chain-of-custody documentation. Sequential numbering, barcode tracking, and detailed recordkeeping capabilities ensure your deposit bags meet regulatory requirements and internal security protocols.

Maintaining a traceable trail for each deposit helps reduce internal theft, ensure accountability, and support investigations if discrepancies arise. Businesses with multiple locations or staff shifts especially benefit from automated tracking features that simplify audits and reduce manual errors.

Industry-Specific Standards

Consider your industry’s specific standards when selecting bags. Financial institutions may require different features compared to retail operations, and armored car services often mandate specific bag types and security levels.

For example, banks often follow strict compliance rules requiring tamper indicators, unique serial codes, and enhanced locking systems. On the other hand, retail environments might prioritize visibility and convenience, using transparent bags for quick check-ins and easier deposit processing. Matching bag features with your field’s norms helps avoid costly compliance issues.

How to Choose the Right Bank Deposit Bag for Your Business

Not all deposit bags are created equal. Choosing the right one depends on how often you deposit, how much cash or paperwork you transport, and what kind of security your workflow requires. The steps below guide you through finding the most practical and cost-effective solution.

Step 1: Volume and Frequency Analysis

The 2024 findings revealed consumers made more payments in 2023 than in previous years, with cash’s share decreasing in favor of credit and debit cards, but overall cash use remaining stable. This stability means businesses still need robust cash handling solutions.

Start by analyzing your cash handling volume and frequency of bank deposits. High-volume operations benefit from cost-effective single-use bags, while businesses making fewer deposits might prefer durable reusable options that provide long-term value.

Step 2: Security Risk Assessment

Evaluate your security requirements based on the value of typical deposits and the level of risk in your operating environment. Higher-risk situations warrant premium bags with advanced tamper-evident features and robust construction.

Step 3: Operational Integration Factors

Consider operational factors such as:

- Staff training requirements for different bag types

- Storage space for bag inventory

- Integration with existing security protocols

- Cost per use versus initial investment

- Shipping and handling considerations

Step 4: Use Case Matching Strategy

Match specific features to your use case requirements. Retail operations might prioritize clear bags for quick verification, while financial institutions may focus on advanced tracking capabilities and regulatory compliance features.

FAQs

What size deposit bag do I need for daily cash drops?

A 9″ x 12″ deposit bag works for most daily cash, check, and receipt deposits. High-volume businesses may prefer 12″ x 16″ bags.

Can deposit bags be recycled or reused?

Plastic deposit bags are single-use due to tamper-evident closures. Fabric or nylon bags can be reused if cleaned and inspected properly.

Where can I customize deposit bags with my brand?

Most suppliers offer custom printing for logos and color coding. Check for minimum quantity and pack sizes before ordering.

Conclusion

Selecting the right bank deposit bag requires careful consideration of materials, size, security features, and compliance requirements specific to your business operations. The right bag can cut risks, improve accountability, and support your business’s bottom line. So, don’t compromise your security – protect your business with professional-grade deposit bags.

Secure Your Business with Bank Deposit Bags from Shosky Security

Looking for tamper-evident, durable, and compliant bank deposit bags? Shosky Security offers high-quality bags designed to handle cash, checks, and documents with confidence. Whether you need single-use or reusable options, we’ve got the right fit for your workflow. Browse our full range today and contact us to get the perfect deposit bag to protect your business.