Security is a fundamental concern for banks, as they are prime targets for a wide range of criminal activities. For this reason, implementing robust security measures is paramount. One of the most effective measures to enhance the security of banks is through the use of tamper-evident products.

These solutions serve as a vital line of defense by providing clear indications of unauthorized access. So, by integrating these tools into daily operations, banks can deter theft, prevent fraud, and reinforce trust with customers. This article will explore the best practices and solutions to help banks secure their operations using these technologies.

Risks You Need to Know About Bank Security

Banks face a wide range of security risks that threaten their assets, data, and operations. Common threats include the theft of money, documents, and valuables, often perpetrated by criminals targeting less secure areas of the bank.

Unauthorized access to vaults, safe deposit boxes, and restricted zones is another significant concern, as it can result in massive losses if not carefully monitored.

Fraudulent activities, such as money laundering, identity theft, and tampering with financial records, are also risks that undermine the bank’s integrity.

These vulnerabilities highlight the need for robust security measures to ensure the safety of both the bank’s operations and its customers’ accounts.

To better understand the comprehensive nature of these challenges, it’s helpful to categorize the primary security risks that financial institutions encounter:

| Security Feature | Description & Benefit |

|---|---|

| Tamper-Evident Seals | Designed to visibly indicate any unauthorized access; may change color, display "VOID," or tear if tampered with. Crucial for high-security. |

| Adhesive Closures | Strong adhesives prevent easy opening; some bags feature double strips or locking mechanisms for enhanced protection. |

| Unique Serial Numbers/Barcodes | Allow for easy tracking and verification of each bag, reducing errors or fraud; especially important for high deposit volumes. |

| RFID Blocking | Material prevents electronic theft of data from cards or other RFID-enabled items within the bag, safeguarding sensitive information. |

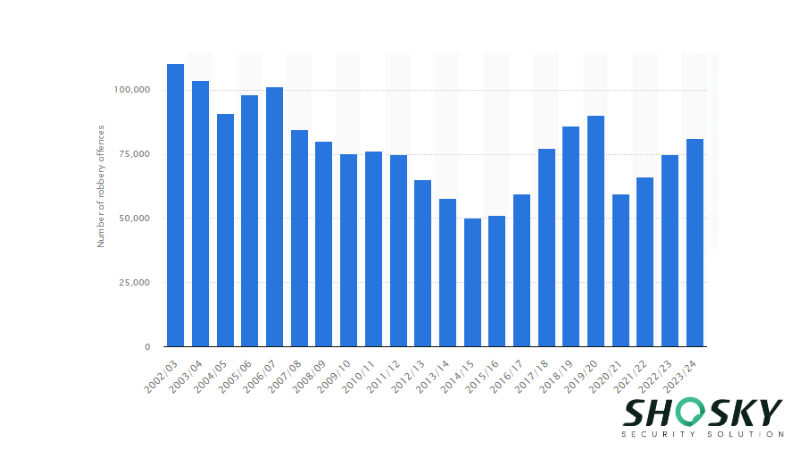

As financial institutions increasingly navigate digital threats, bank robberies are becoming a growing issue. According to the Financial Crimes Enforcement Network (FinCEN), over $1 billion is lost annually in the United States alone due to thefts—both traditional and digital—underscoring the urgency for banks to implement comprehensive and advanced security measures.

Types of Tamper-Evident Products for Bank Security

Banks leverage a variety of specialized tamper-evident products, each designed with unique features to secure different assets and points of access. Now, let’s explore some of the most common types of tamper-evident products widely adopted in the banking sector.

Tamper-Evident Bags

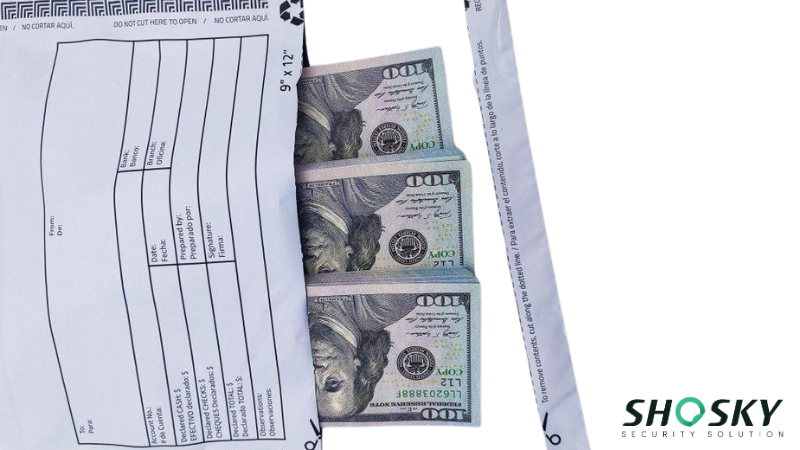

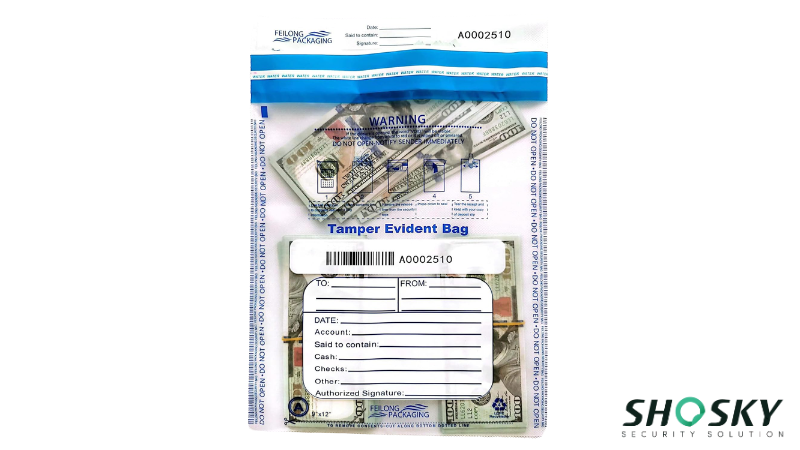

Tamper-evident bags are a type of bag that is specially designed to provide secure storage and transportation of valuable items, such as cash, documents, and sensitive materials.

Unlike standard bags, these bags are manufactured with unique materials and features that make tampering easily detectable.

When the bag is sealed, any attempt to open or alter the contents leaves visible evidence (such as broken seals, torn seams, or altered adhesive), which is crucial for protecting assets during transport or storage.

Here are the common types of tamper-evident bags, along with their applications:

- Self-Sealing Bags: These bags feature an adhesive strip that allows for easy sealing and re-sealing. They are convenient for storing and securing documents and cash without the need for additional sealing equipment.

- High-Security Bags: Designed for high-risk items, these bags are reinforced with advanced materials and are often used for transporting large sums of money or sensitive documents. They typically are sealed with tamper-evident tape (or security bag tape) for added protection.

- Opaque Bags: Often used to conceal the contents, opaque bags prevent visibility, ensuring that the contents cannot be seen or accessed without detection. These are ideal for transporting confidential documents.

These various types of tamper-evident bags provide versatile solutions for securing physical assets throughout the banking workflow, from internal handling to external transport, ensuring that any compromise is immediately identifiable.

To meet the stringent requirements of bank operations, these bags go beyond simple adhesive strips. Key features to look for include:

- Unique Serial Numbers and Barcodes: Each bag comes with a unique, sequential serial number and a corresponding barcode that is often linked to the bank’s internal tracking software. This creates an unassailable audit trail.

- Tear-Off Receipts: A portion of the bag with the serial number and barcode can be torn off after sealing, providing the customer with a tracking receipt for their deposit.

- Thermochromic or Chemical-Reactive Adhesives: These advanced adhesives will display a “VOID,” “OPENED,” or other message when exposed to heat, cold, or chemical solvents, making attempted tampering instantly visible.

By incorporating these high-tech features, tamper-evident bags become a crucial part of a bank’s security protocol, providing multiple layers of protection and accountability that are essential for modern financial operations.

Tamper-Evident Tape

Tamper-evident tape, also known as security tape, is used to seal packages, documents, and containers, ensuring that any attempt to open or alter the contents is immediately visible.

Unlike standard tapes, this tape is designed to break or leave behind a visible mark when tampered with, providing clear evidence of unauthorized access.

Here are the common types of tamper-evident tapes, along with their applications:

- Full Transfer Security Tape: This tape leaves a full transfer of the printed message or security feature on the surface to which it is applied. If the tape is removed, the message is transferred to the surface, making tampering immediately obvious.

- Non-Transfer Security Tape: This tape does not leave a transfer on the surface, but it still features tamper-evident marks that are clearly visible if the tape is disturbed. It is ideal for applications where full message transfer is not required.

- Partial Transfer Security Tape: This type of tape only partially transfers its message or image when tampered with, allowing for a more discreet indication of tampering. It is ideal for cases where some level of subtlety is required.

- Serial Number & Perforation Security Tapes: These tapes come with serial numbers and perforations that create a secure seal. The serial number allows for easy tracking, and the perforations ensure that the tape cannot be resealed without leaving clear evidence of tampering.

By utilizing these specialized tapes, banks can ensure the integrity of sealed packages and documents, providing an essential layer of protection against unauthorized access and manipulation of sensitive information or assets during storage and transit.

Tamper-Evident Seals

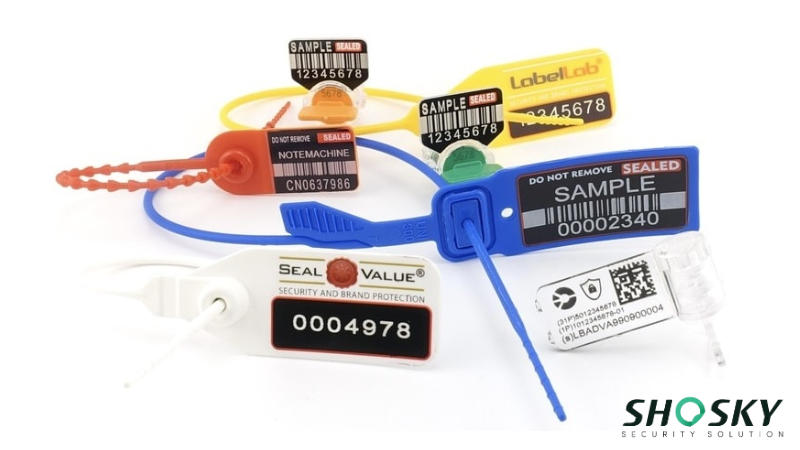

Tamper-evident seals, also known as security seals, are designed to secure containers, doors, and vaults, offering a clear indication of any unauthorized access.

Despite the rise of digital threats, physical security remains paramount in banking. The FBI reported 1,263 bank robberies and additional burglaries and larcenies against federally insured financial institutions in 2023 alone, underscoring the ongoing need for robust physical deterrents.

Unlike standard seals, these seals are typically applied to storage units, ATMs, or cash deposit bags and are designed to break or show visible damage if tampered with.

Their primary purpose is to ensure the integrity of the security system by signaling any breach immediately.

Tamper-evident seals are a critical component of a bank’s security strategy, with specialized use cases for high-risk areas:

- ATM Cassette Seals: These seals are used on the cash cassettes within ATM machines to ensure they have not been tampered with between the cash-counting room and the ATM itself.

- Vault and Door Seals: High-security metal or cable seals are used on vault doors to provide a secondary layer of physical security and an immediate visual cue if the vault has been opened after a shift.

- Currency and Bag Seals: A bank uses numbered plastic seals to secure bags of currency, providing a clear visual chain of custody for all cash transfers.

Here are the common types of tamper-evident seals, along with their applications:

- Plastic Seals: Lightweight and easy to apply, plastic seals offer a cost-effective solution for securing containers and doors. They are commonly used in ATM machines or deposit boxes.

- Metal Seals: More durable than plastic seals, metal seals provide a higher level of security, especially in environments that demand robust protection. They are often used for securing high-value items or sensitive areas.

- Holographic Seals: Featuring holographic or other unique visual indicators, these seals provide an extra layer of authentication, making them harder to counterfeit and ensuring higher security.

The application of these seals across different bank assets, from physical vaults to cash deposit points, reinforces security by providing a visible and immediate indicator of tampering attempts, thus deterring theft and unauthorized entry.

How to Implement Tamper-Evident Solutions in Your Bank

Protecting your bank’s assets and maintaining customer trust requires a proactive approach to security. This guide outlines a five-step process for effectively implementing tamper-evident solutions to enhance your bank’s security posture.

Step 1: Assess Your Bank’s Security Needs

Start by thoroughly assessing your bank’s security requirements. Identify areas where heightened protection is needed, such as money transit, document storage, vaults, and ATMs.

Analyze the risks associated with these assets and determine which tamper-evident products (bags, seals, tape) are most suitable for securing them. This process will allow you to sort through available options and identify what works best to protect the bank’s assets and accounts.

Step 2: Select the Appropriate Tamper-Evident Products

After assessing your needs, choose the tamper-evident solutions that match the level of risk and the value of your assets. Consider factors like the environment in which these products will be used and the protection required for each asset.

Products such as tamper-evident bags for cash handling and stock protection, security seals for vaults, and tape for securing documents are great options.

Step 3: Establish Protocols for Usage

Next, create standardized protocols for using tamper-evident products across the bank. Define specific procedures for applying security seals, bags, and tape, and establish a system for inspecting and replacing these security measures.

For example, a clear protocol for cash handling would involve a two-person verification process. One staff member seals the bag and logs the unique serial number, while a second staff member verifies the seal’s integrity and cross-references the number, ensuring a secure and verifiable chain of custody.

Ensure that these protocols align with your bank’s broader security strategy and that they cover all areas identified in Step 1, guaranteeing that all assets are secured from unauthorized access.

Step 4: Implement Security Measures Across the Bank

Once your protocols are in place, implement tamper-evident products across your bank. Ensure relevant departments, including cash handling and vault maintenance, are equipped with the necessary tamper-evident technology and solutions.

Integrate these measures into your daily operations to consistently protect high-risk assets, minimizing the chance of unauthorized access to valuable items like cash, documents, and account details.

Step 5: Continuously Review and Improve Security Measures

Since security threats evolve over time, it’s essential to regularly review and update your tamper-evident security measures. Stay informed about new advancements in tamper-evident technology, and assess how they can further strengthen your bank’s protocols.

Encourage staff to provide feedback on the effectiveness of these products and use audit results to refine your security practices, ensuring your bank remains a safe environment for all assets.

Best Practices to Implement Tamper-Evident Solutions in Banks

To successfully integrate tamper-evident solutions into banking operations, it is essential to follow best practices that ensure security and compliance. One of the most important steps is staff training. Develop a comprehensive training program covering the following areas:

- How to apply tamper-evident products correctly to ensure security.

- How to identify tampering signs quickly and report them.

- The importance of tamper-evident solutions in protecting assets, preventing theft, and maintaining customer trust.

These training sessions should be hands-on and interactive, allowing employees to fully understand the correct application and procedures for using tamper-evident products.

Additionally, offering a variety of regular free courses and a clear code of conduct for staff who join will help maintain high security awareness and ensure all employees are up to date with any new products or protocols.

Another key best practice is to implement consistent monitoring and audit procedures to track the use of tamper-evident solutions.

Regular audits are essential to filter out inefficiencies and assess whether these products are being applied correctly. These audits also allow banks to search for areas of improvement and any signs of non-compliance.

Make sure these procedures help add value by ensuring continuous improvements to security practices. Regularly read audit reports and click-through feedback to identify potential risks and take appropriate action.

By ensuring that tamper-evident solutions are used correctly and consistently, banks can strengthen their security protocols and protect valuable assets.

How and Where to Buy Tamper-Evident Solutions for Banks

Acquiring the right tamper-evident solutions is a crucial step in strengthening your bank’s security. To ensure you make informed decisions and select products that truly meet your needs, follow these key steps:

Assess Your Security Needs:

- First, clearly define what you need to protect: cash, sensitive documents, or other high-value items.

- This assessment helps you choose the right product type, such as bags, seals, or labels, for your specific operational requirements.

Find Specialized Suppliers:

- Seek out established vendors who focus on tamper-evident solutions for banks.

- Verify that their products comply with industry regulations.

- Ensure they offer customization options to fit your bank’s security standards and can address various challenges.

Choose a Reputable Partner:

- Select a supplier with a solid reputation and proven experience.

- Look for companies offering excellent customer support and necessary compliance documentation.

- Many provide online ordering for easy browsing, bulk requests, and product customization.

By diligently following these guidelines, your bank can confidently acquire tamper-evident solutions that not only provide robust protection but also seamlessly integrate into your existing security framework.

FAQs

Are tamper-evident bags suitable for securing valuable documents?

Yes, tamper-evident bags are ideal for securing sensitive financial and legal documents and providing visible proof of tampering.

How can tamper-evident solutions help with cash handling?

These solutions enhance cash management by preventing theft, reducing errors, and ensuring secure handling during transit and storage.

Are tamper-evident solutions cost-effective for banks?

Yes, investing in tamper-evident solutions is cost-effective in the long run by minimizing security risks, preventing theft, and ensuring regulatory compliance.

Conclusion

Ensuring the security of bank operations is more critical than ever in today’s environment. By integrating tamper-evident solutions, banks can significantly reduce the risks of theft, fraud, and unauthorized access. With their long-term cost savings and security benefits, tamper-evident products are a smart investment to protect both the bank’s assets and its customers’ trust.

Shosky Security – Leading the Way in Bank Security!

Shosky Security provides top-tier tamper-evident solutions specifically designed for the banking sector. Our range of products, from tamper-evident bags to seals and labels, offers unmatched security to protect your financial operations. Get in touch with us today to discover how Shosky Security can help enhance your bank’s protection with trusted tamper-evident solutions.